But how do you know if it’s a good plan for you?įirst, learn everything you need to know about how to refinance your mortgage. And that will save you thousands in the long run. That usually results in a higher mortgage payment, but it also gives you a quicker payoff date. The right way to refinance is to sign up for a shorter mortgage term. Save more money for the things that matter (to you) with EveryDollar. But all it really does is keep you in debt longer. And sure, that might free up some money in your budget today. Figure out if refinancing your mortgage is right for you.Ī lot of people refinance to get a lower monthly payment. It’s another small habit that’s super simple and will add up to some serious savings.ħ. And turn the tap off while you’re doing everyday things, like brushing your teeth or shampooing your hair. Don’t run the dishwasher unless it’s full. For example, work on using less water around the house. You can also cut spending by lowering your bills. For a small investment in ingredients, you can save big in the long run on a lot of the daily essentials. The list of DIY options is longer than this article.

Budget dave ramsey full#

Pinterest, YouTube and social media are full of tutorials on how to make your own soaps, household cleaners, dog food, laundry detergent, ant killer, face scrubs-you get the idea. Make your own things around the house.ĭon’t spend money on things you can make yourself. This is a quick and incredibly simple way to cut your spending every time you shop!ĥ.

But look into how much you could save by buying generic grocery items, medications, trash bags, cleaning supplies and more. You can splurge on a few items-that’s your right as a shopper. It’s a small change that will add up over time. Switch to reusable items.īecause guess what-using the hand towels you already have tucked in a drawer or cabinet somewhere instead of a new paper towel sheet every time you make a mess means fewer trips to the store (and to the dumpster). Stop buying paper towels, sandwich bags, and single-use water bottles. Okay, here’s a tiny, practical way to cut spending. This makes your home a blessing instead of a financial curse.

Budget dave ramsey plus#

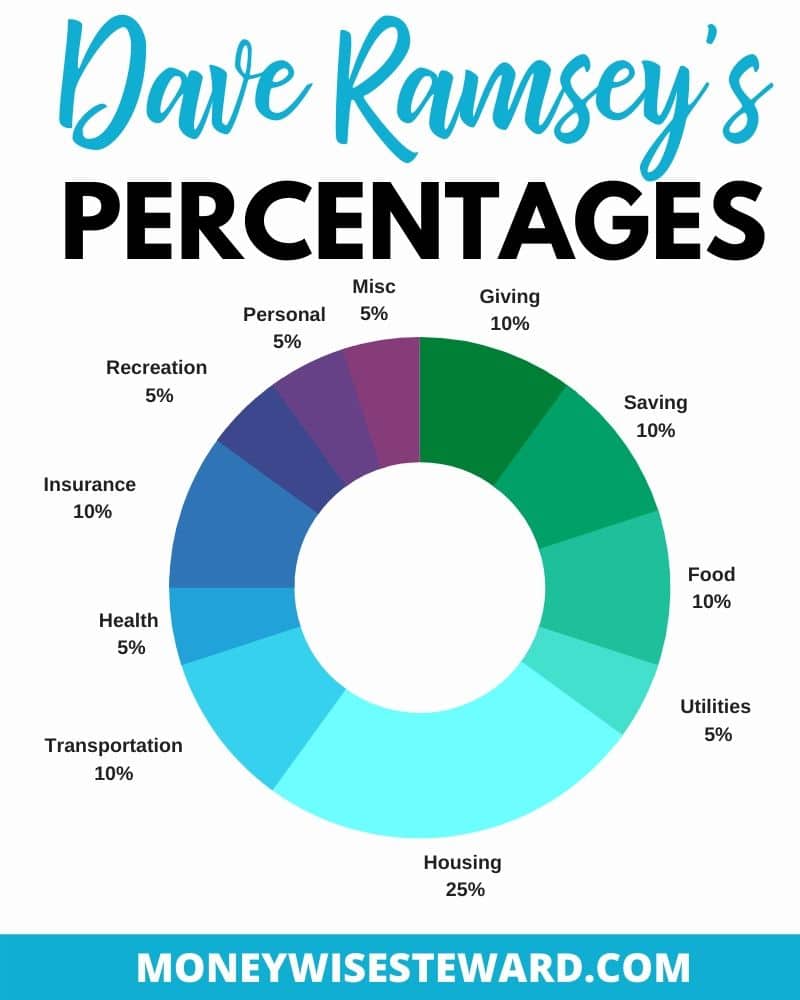

(That includes your rent or mortgage plus HOA fees, taxes, insurance and PMI). But you don’t want to spend so much on your house that you can’t afford to make other money goals happen.ĭon’t be house poor-be house wise by making sure you’re not spending more than 25% of your take-home pay on housing. You’re house poor when too much of your income goes toward your mortgage or rent, leaving you feeling poor in all other areas. Green changes like these can keep more green in your wallet. But they all pay off in the end.įor example, you can save on home expenses by turning off the lights when you leave a room, buying lightbulbs that have earned the Energy Star, buying a programmable thermostat, or washing your laundry in cold water instead of hot. Some of these are financial investments up front. The first way to cut spending in your home is to make more energy-efficient life choices. Saving on home expenses can mean changing up small habits for bigger savings over time, or in some cases, making a pretty big change for an instant win. Here you go: 24 ways to cut spending and save more money! But you might need some inspiration for where to start. If you want to save more money, maybe to invest in retirement or add some cushion to your budget each month, one surefire way to do that is to cut spending.

0 kommentar(er)

0 kommentar(er)